what is iFactFind?

iFactFind™ is a cloud-based application for holistic financial advisers and planners looking to professionalise and update their manual, static client fact-finding process.

Being able to make amendments and keep it as a live document, rather than a data collection from a point in time, makes it invaluable as a Client Record Management system.

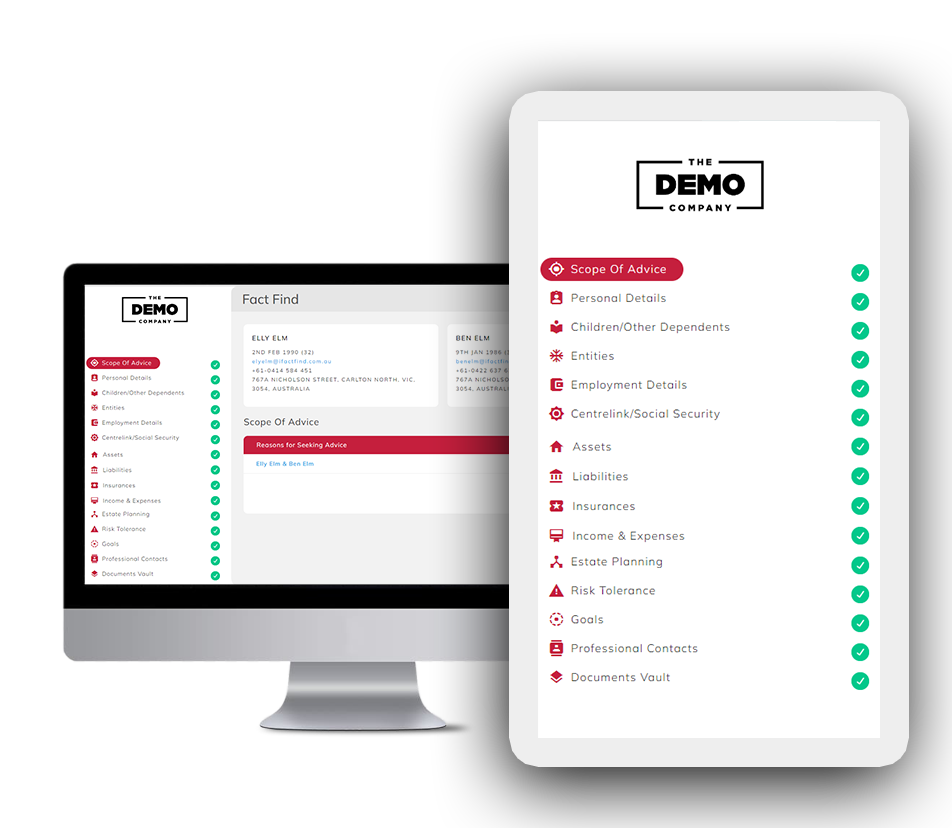

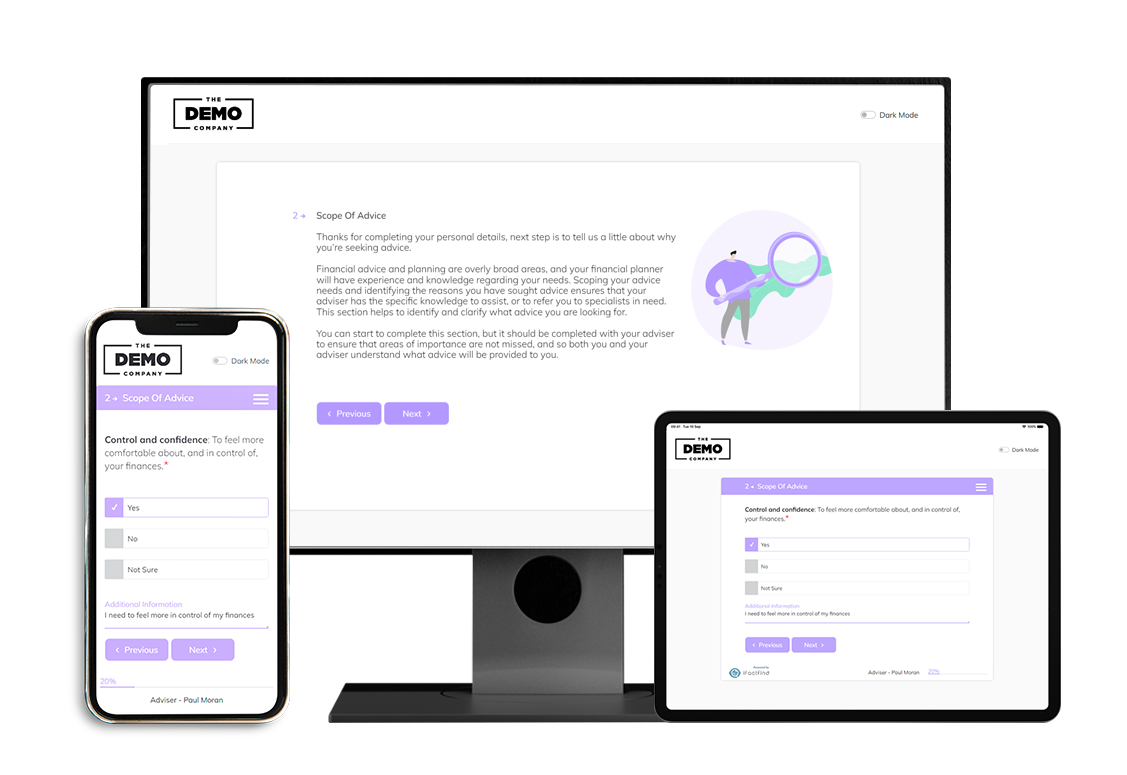

Scope of Advice

Our scoping tool promotes our offering, prompts clients to consider all areas of advice, and encourages a discussion about what they really need.

In addition, we can customise and hard-code the questions to suit the specific areas of advice you offer.

Client Goals

iFactFind uses a Master Goals List format that allows you to demonstrate all the various goal categories to ensure a holistic approach.

We strongly recommend that Advisers work with their clients to complete these goals using our two-step process that combines SMART with values and preferences.

Risk Tolerance

iFactFind provides an embedded ten-part risk tolerance questionnaire, including situational risk questions such as relative wealth, source of wealth and stage of life.

Advisers also have the ability to override the output, subject to the detailed discussion you have with your client and a detailed description of the reasons for the change.

Personalised Fact Find

Using iFactFind’s settings function, you can personalise which sections of the fact find need to be completed, subject to the Scope of Advice.

A risk-only client – turn off the investment risk tolerance section, Retired clients – turn off the personal insurances section, No entities involved – turn off the entities section!

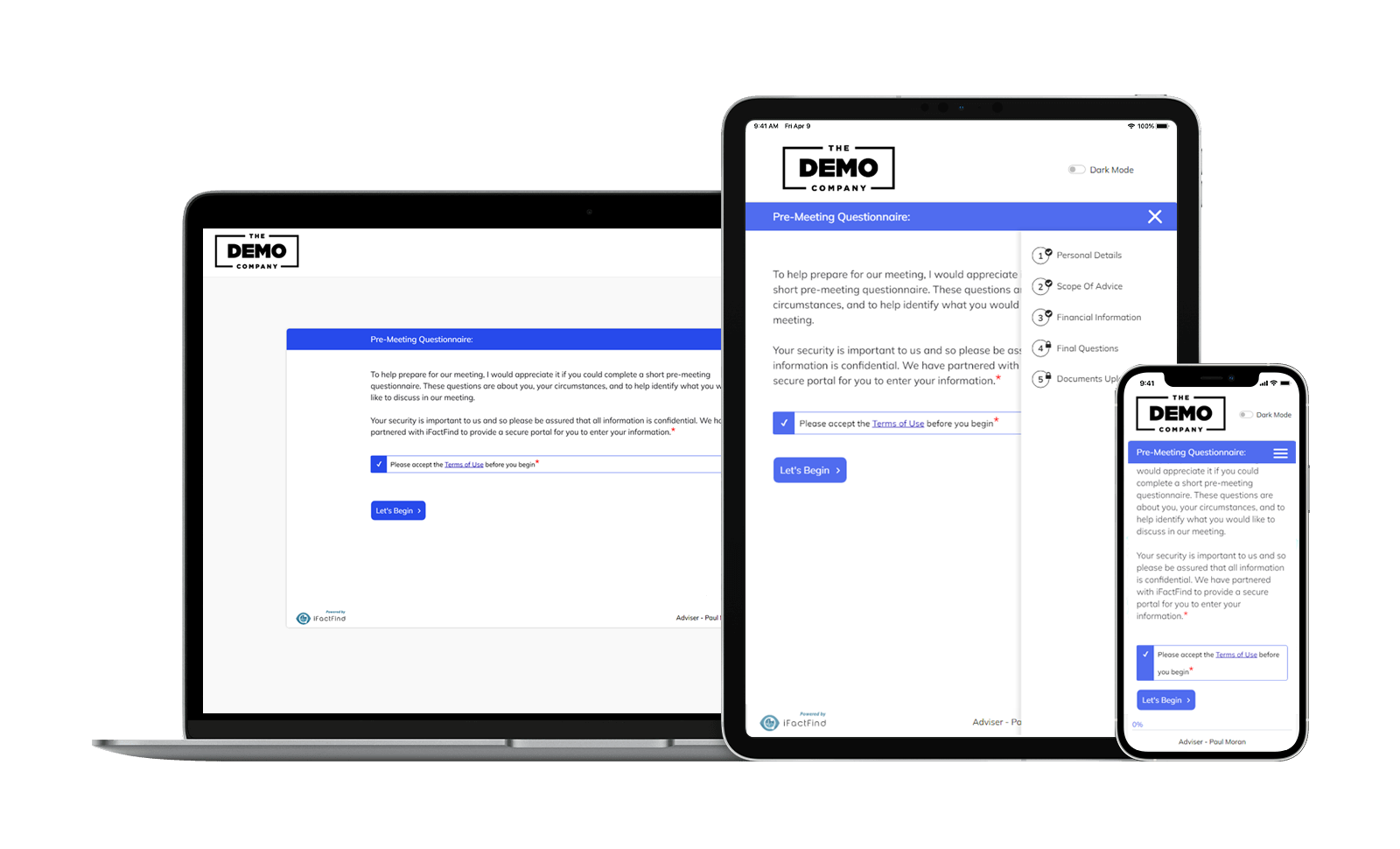

Mini Fact Find

Choose from our standard or basic pre-meeting questionnaires designed to be sent out before initially meeting your prospective client.

You also have the option to send the pre-meeting questionnaire link via SMS. Your client can then choose to complete this on their phone, tablet or laptop/desktop.

Integration

Our APIs allows data collected in iFactFind to become source data for other financial planning applications. We have developed an API architecture that allows integration with all providers who offer similar interfaces to work together to simplify data transfer and improve efficiency.

Review workflow

Include your client’s review data within their profile so you can utilise our automated review reminder workflows. Set up automated reminder emails to your clients prior to their upcoming review date. You can choose to include your practice-specific client login link and a prompt to remind your client to log back into their fact find.

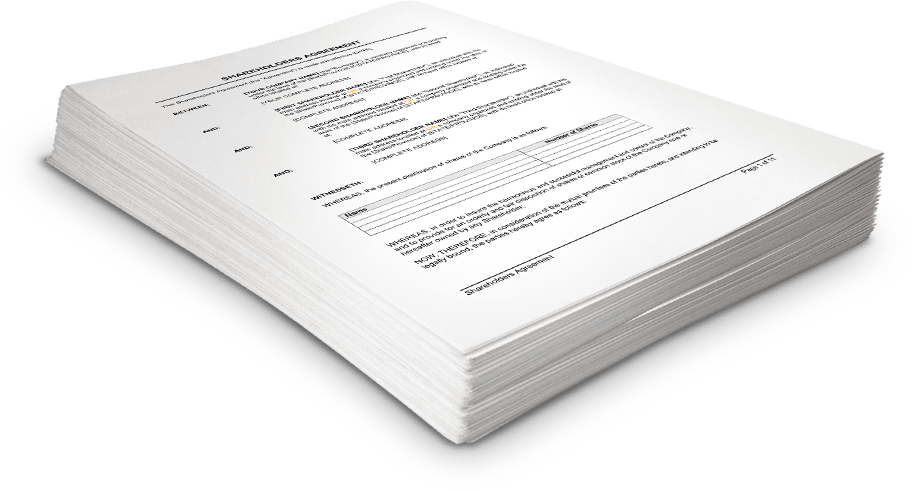

Document Generation

You can produce Third-Party Authorities and other documents at the push of a few buttons.

Our Document Generation function means you can create any documents you want by linking your text with our extensive list of placeholders.

Build and edit documents that can be created in MS Word or PDF format, create and publish templates and start your own document library using any of the thousands of API fields we have created for users.

e-Signature

Capture confirmation from your client that all information entered in their fact find is UpToDate and correct. Once their e-signature is captured, a PDF version (which we call a Snapshot) of the fact find is generated with all data entered. This document is dated and time stamped with a unique version identifier that can be referenced in your advice documents such as SoA’s and RoA’s.

By definition, holistic financial planning involves considering all our client’s goals - unfortunately, we know that clients only consider myopic goals. So we call this WINIWIMI – What Is Next Is What Is Most Important.

Without help and advice, clients often fail to identify all the goals that will lead to a happy and successful future.

iFactFind uses a Master Goals List format that allows you to demonstrate all the various goal categories to ensure a holistic approach. We strongly recommend that Advisers work with their clients to complete these goals using our two-step process that combines SMART with values and preferences.

Our APIs allows data collected in iFactFind to become source data for other financial planning applications.

Choose from our standard or basic pre-meeting questionnaires designed to be sent out before initially meeting your prospective client.

Once you’ve chosen which questionnaire you’d like to send, you can choose to include FSG delivery at this time. You also have the option to send the pre-meeting questionnaire link via SMS.

Your client can then choose to complete this on their phone, tablet or laptop/desktop. Once complete and submitted by the client, you can view their responses in an exportable PDF.

Holistic financial planners aren’t robo-advisers! They need real, detailed and accurate data about their clients to be able to help them make the right decisions. We know that this information is a lot more thorough than the simple solutions currently being promoted as financial advice.

Holistic financial planners and advisers must make sure they consider all the angles (tax, timing, actual investments, real and detailed goals and more) before making recommendations and then be able to justify those recommendations with supporting evidence.

Well, typically it is completed with paper-based fact find or at best with an on-line form. Neither of these methods provide actual database capabilities that can be properly recorded, retrieved or analysed. What we finish up with is an incomplete set of data collected at a single point of time that must be re-entered into your financial planning software and that requires significant follow-up if you want an accurate picture of your client’s true position.

iFactFind™ provides true database capability into your client data collection. The smart use of data feeds and API’s mean that there is no need for reverse fact finds prior to client reviews – in fact, you will be able to ‘snapshot your client’s current situation each time you provide advice and have that stored for compliance purposes at the push of a button.

Rather than simply waiting for the information, the adviser has live access to what the client has completed. Client information is gathered collaboratively so that the ‘helping’ relationship commences early in the relationship. You will know what is outstanding, who is committed to completing (and whose commitment is waiving), all via the adviser dashboard. Additionally, any details you obtain can be directly entered into the client file – on the go.

iFactFind is sold as an annual commitment (paid monthly or yearly)OR no commitment (pay as you go).

Before starting a 21 Day Trial, we recommend that you complete our 60 Minute Zoom Tutorial. This will ensure that you will get the most out of your Free Trial.