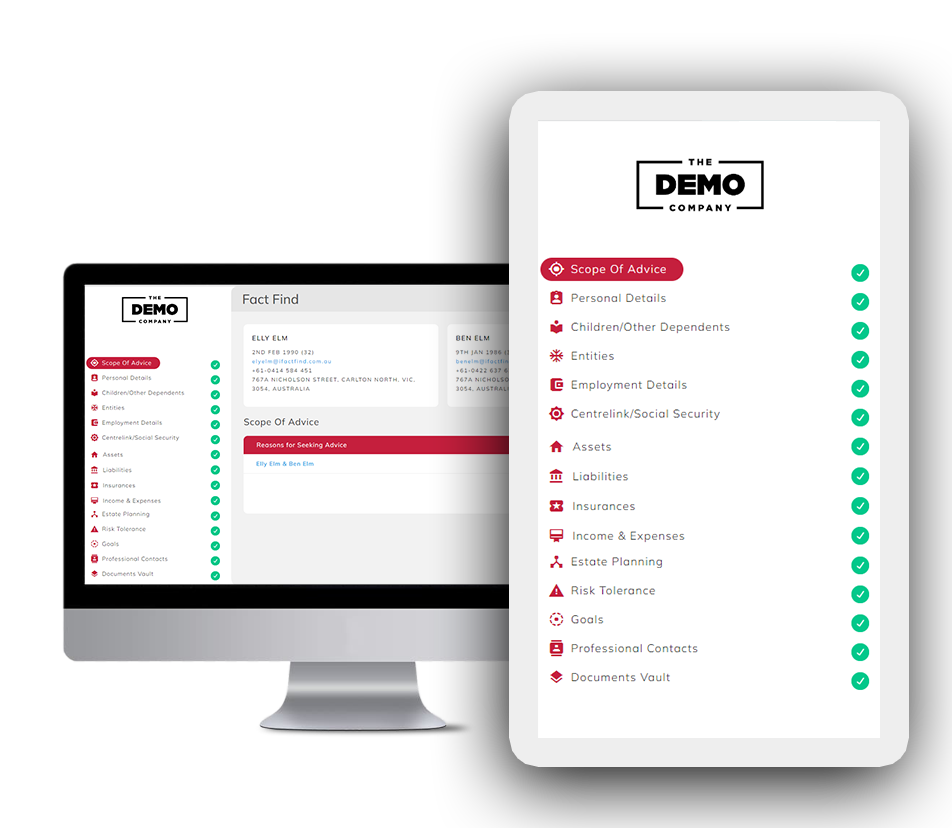

Comprehensive

Holistic financial planners aren’t Robo-advisers! They need real, detailed and accurate data about their clients to be able to help them make the right decisions. iFactFind is the digital, on-line solution.

We know that this information is a lot more thorough than the simple solutions currently being promoted as financial advice. Holistic financial planners and advisers must make sure they consider all the angles (tax, timing, actual investments, real and detailed goals and more) before making recommendations and then be able to justify those recommendations with supporting evidence.

The iFactFind data collection sequence has been designed to minimise the duplication of information. The objective of this approach is only to require a single point of collection that becomes a single source of truth (SSOT is the practice of structuring information models and associated schemata such that every data element is stored exactly once).

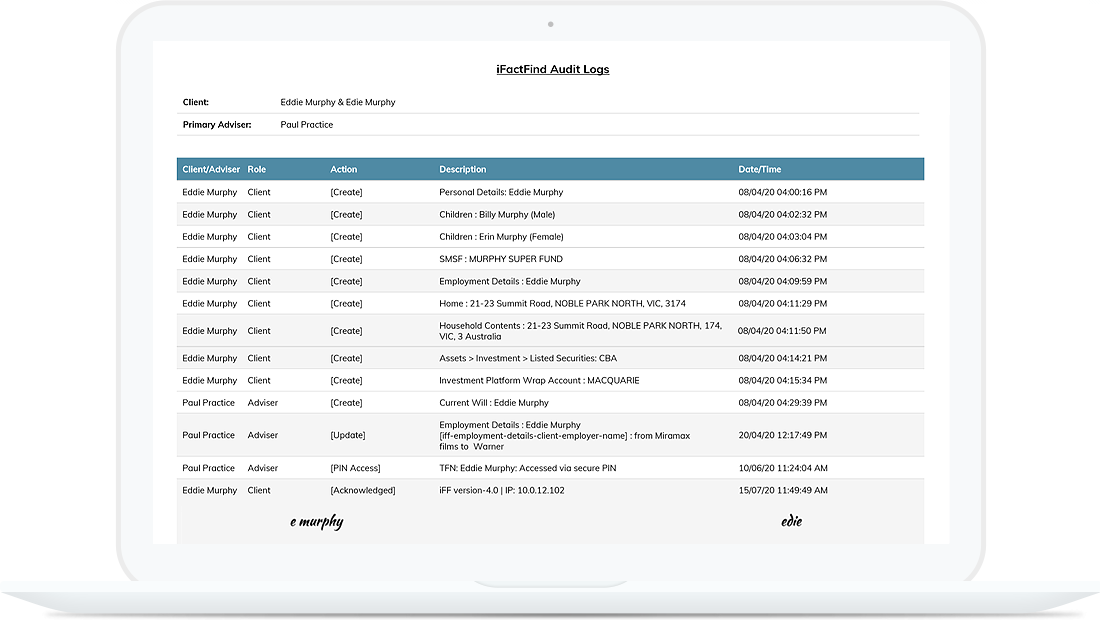

Compliance

The iFactFind digital fact find has moved the paper-based fact find into the new age of compliance and accountability. Auditing and recording who, what and when – every time information is added or edited. iFactFind considers compliance from two angles:

- The Planner/Adviser under their Code of Ethics obligations

- The client when considering the origins of the information provided

Under the Code of Ethics, Financial Planners and Advisers are now obliged to gather more information about the client than ever before. No longer can advisers gather ‘just enough’ information as the code requires us to anticipate issues for our clients AND their immediate family. iFactFind places the obligation on the client to specify if they don’t want to answer specific questions.

There will be no more arguments about who entered information when everything is recorded in an audit log. Advisers (and support staff) and clients are tracked separately, so that you can identify who added or amended details, what those details were, and when the change was made. We’re sure that the compliance managers will be happy too.

Security

The iFactFind on-line infrastructure resides in secured facilities in Australia managed by Amazon AWS™ and is monitored 24/7 by automatic processes that detect suspicious or unusual activity.

We use enterprise level technology from Microsoft™, Amazon Web Services™, and other providers that follow the latest security standards. We understand that certain pieces of identification-based information require special security and encryption. For this sensitive information, we use military-grade encryption (AES 256).

iFactFind uses multi-factor authentication to verify the identity (we send a unique code to the mobile linked to the account). The data is decrypted and only be presented after login is verified, which is why it is important to keep the login credentials secure.

iFactFind goes above and beyond to keep data safe. Your client’s Personal and Financial information is segregated. All personally identifiable information and financial information are kept on two different systems. Both parts of data are scrambled with different sets of encryption keys. A hacker would have to penetrate both systems and would need to know all the keys to link the information together. We use Threat Intelligence – a cyber security specialist - to check our system is safe and secure.

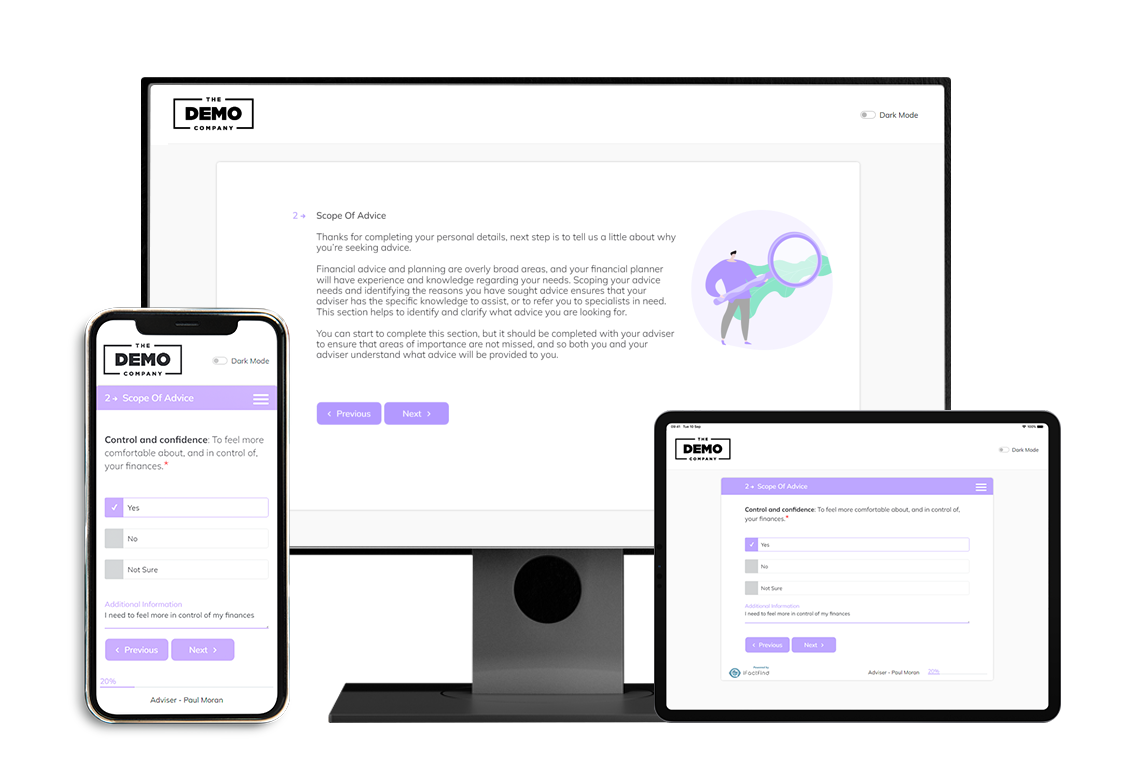

Collaboration

iFactFind has been designed and built from the ground up with interactivity between advisers and their clients front of mind. We didn’t just bolt on a client portal – it was integral to the overall design.

Track your client's progress in Real-Time via the adviser dashboard and provide help where needed. We want to ensure efficient conversion from an Initial Prospect to an Ongoing Client.

Advisers and their clients can work collaboratively to gather all the required information to provide effective advice. The use of online help functions as well as a “Contact Advisor” button ensures timely and accurate completion of Fact Find. It is easy to complete the iFactFind collaboratively through Zoom, Skype, Microsoft Teams or whatever platform you choose. Both adviser and client can log in at the same time and with the technology of screen-sharing, the digital fact-finding process can be completed easily and quickly.

Rather than simply waiting for the information, the adviser has live access to what the client has completed. Client information is gathered collaboratively so that the ‘helping’ relationship commences early in the relationship. You will know what is outstanding, who is committed to completing (and whose commitment is waiving), and when to schedule SoA production all via the adviser dashboard. Additionally, any details you obtain can be directly entered into the client file – on the go.

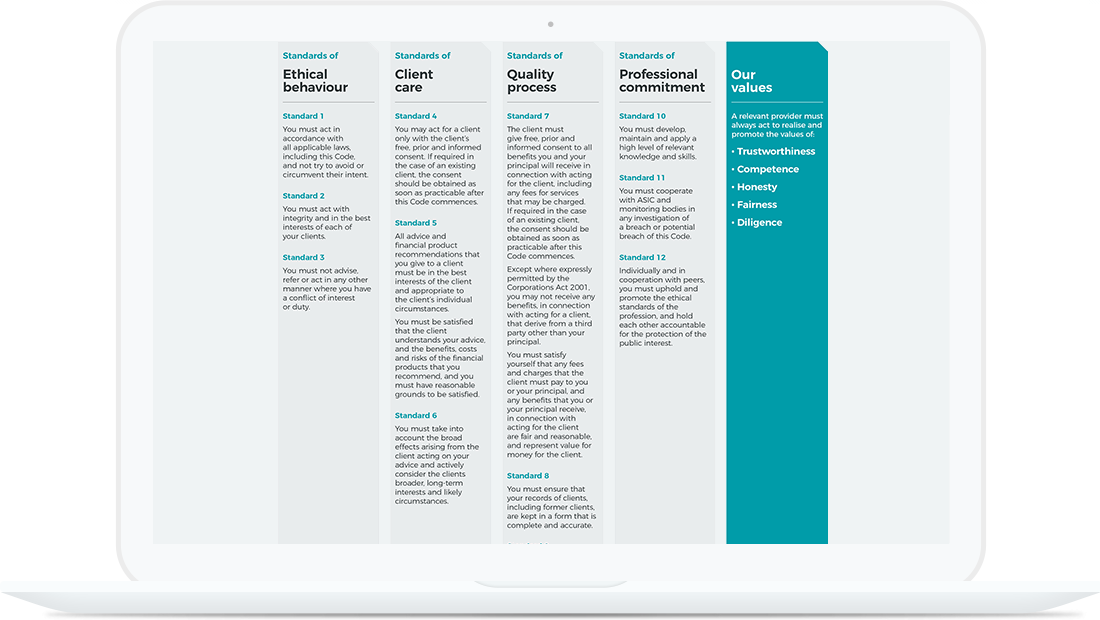

CODE OF ETHICS

Of the 12 standards established under the FASEA Code of Ethics, two standards particularly apply to the need for complete and current client data.

Standard 5 states that “all advice and financial product recommendations that you give to a client must be in the best interests of the client and appropriate to the individual’s circumstances”.

Standard 8 states that “You must ensure that your records of clients, including former clients, are kept in a form that is complete and accurate”.

It becomes clear that Financial Advisers and Planners now have a legal obligation to collect, store and manage complete information about their clients. In fact, updating client records has become a part of the on-going client management requirements. iFactFind has been designed for both existing and new (prospective) clients. For existing clients, all available details can be added by support staff or paraplanner (or adviser) once the client is added to the system. The adding process takes less than 30 seconds. By pre-populating the iFactFind, you will be able to show the client how the information is added when you meet with them and ‘launch’ iFactFind for the client. Once the clients are on the system, they can update information whenever they want, add their latest statements or update employment details. You can simply check the currency of the client information whenever you meet, have the client submit the fact find and you have effectively shown that you have kept client information current and reviewed!

Integration

Our APIs allows data collected in iFactFind to become source data for other financial planning applications. Started with X-Plan, iFactFind now integrates with Worksorted & Fin365. Moving through the rest of the ‘stack’, we aim to make iFactFind the go-to software that independently collects, stores and manages your client data.

The ability to integrate with ‘other’ software is front of mind for many financial planners - We get that. All of the data collected and stored in iFactFind can be made available through the use of API’s (An Application Programming Interface is a computing interface which defines interactions between multiple software intermediaries).

iFactFind is starting with the collection of as much data as we think is reasonable to gather, and an ability to keep adding important fields if needed. Once the data is collected, we can ‘send’ it to other software provided that they allow the links to be built.

The starting point for us is that, even though we may not have all the integrations just yet, the fact that data is being collected by iFactFind in an on-line, digital platform means that the opportunity is there to progressively roll-out these integrations. There is no point continuing to use paper as this will NEVER integrate with anything!